Road building is the oldest type of public work in Union County. In

the beginning trails were blazed by hunters' axes and later came wagon trails.

All the men in a vicinity worked together gratis on a road leading to trading

posts and other sources of supply. Later as more roads were needed a small wage

was paid the men who worked on the road and later men worked out their poll

taxes on the roads.

Plank roads came into use about 1850. This road is

discussed in a previous chapter. Following this dirt roads were used. These

roads were graded and made wide enough for conveyances to pass each other. Later

came gravel roads and finally paved roads.

The first gravel roads were

made and maintained by a toll collected from each conveyance which traveled over

them. Toll gates were located between Jonesboro and Ware on that gravel road and

one south of Anna on another road.

The County Highway Department began

the building and maintenance of roads about 1915. State Aid roads began in 1915.

These were established through a resolution by the County Board of Commissioners

designating certain roads to be added to the State Aid system because there was

more traffic on these roads than others. When the location of a road was

designated by the County Board, the plan of the road was sent to the State

Department of Public Works and Buildings thru its district office at Carbondale

for approval. When the state accepted responsibility for granting state aid to

these roads, the county was required to pay one-half the cost of maintaining the

road. Two roads, one two miles east from Dongola and one one mile east from

Cobden were laid out under this plan and the rest of the roads were maintained

by county funds. In 1927 the motor fuel tax law was enacted which allowed the

county one cent of each three collected. Since then the county has had

approximately $18,000 per year from this fund to construct and maintain roads

which are designed to meet the state highway qualifications. Money can be spent

by counties either for contracts or for day labor work disbursed through the

road commissioners.

Up until 1936 much work was done through contracts.

Since 1936 the county has done its own construction work. The county has spent

much of its money for equipment which it rents to the state highway department

at a rate which practically pays for the original purchase price and upkeep of

the machinery. The machinery is then available after being used by the state for

use on the county roads.

The road districts have their own machinery for

work within the district.

Union County now has eighteen miles of road

built with motor fuel tax funds.

A year ago it was decided by the

government that federal aid road constructed by the government and turned back

to the county for maintenance could be maintained by motor fuel tax funds.

Within the last year eight miles of road have been completed and peven more

miles are planned and right-of-way condemnations are being held in court to

carry out this plan.

There are six hundred miles of ordinary public roads

in Union County, one hundred twenty-seven miles of state aid road and fifty-six

miles of concrete roads. Four miles of black-top road is being built out of

state reforestation funds connecting Cobden with the Black Diamond Trail. This

is a scenic view road.

The concrete roads were built and are maintained

by the state.

In 1940 the county road commissioners were Mr. Landis, Mr.

Mcintosh, Mr. Thornton, Mr. Casper, Mr. Stegle, Mr. Barringer, Mr. Norton, Mr.

Lingle, Mr. Bauer, Mr. Orr and Mr. Rendleman. There are eleven districts in the

county. Mr. Loren Hinkle is county Superintendent of Highways. Each commissioner

hires a clerk and a laborer. The rest of the work is done by W. P. A. and relief

labor.

The county owns $20,000 worth of machiney and if this machinery

were not used as it is by the state, the county income from motor fuel tax would

not be sufficient to maintain the county roads. This income would not much more

than keep up the bridges.

Two W. P. A. gravel pits are in operation in

the county. One novamlite pit is in operation near Alto Pass, but this gravel is

used in Jackson county. The gravel from the W. P. A. pits is loaded into county

owned equipment and hauled to all the road districts. Each district pays

fifty-four cents per yard loading cost.

Few counties keep a Highway

Commissioners reports but Mr. Hinkle has compiled a very complete reports which

shows just how much money has been spent and how much work has been completed in

each road district each month and how much money is available to complete the

work of the districts during the year.

A tax levy is made the first of

each September to obtain money to be expended for construction of roads and

bridges, the maintenance of roads and bridges, road drag funds, purchase of

machinery, repairs for machinery, oiling of roads, prevention and extirpation of

weeds, buildings, administration and contingencies.

All tax warrants are

listed in the report so that each district knows just where it is with reference

to the budget all during the year. A record of all bank receipts and balances is

kept, tax money and private work pay, etc., is listed. Also anticipation

warrants are listed to be counted against future income so that the county knows

just how much is available at all times for road work.

During the last

twenty-five years the towns of Union County have improved their streets. Few

streets in any of the towns are without gravel and many are paved.

Most

of the towns have also put in water systems.

The study of personal taxes reveals a number

of things, the prosperity of the county, the standard of living, the percent of

people well-to-do or poor, the types and number of businesses, etc.

Since

1860 personal taxes have increased. In 1860 when the population was 11,145 there

were 2149 persons paid personal taxes which indicates that all these people had

furniture, livestock, stock in trade, etc., amounting to more than fifty

dollars. In 1900, when Union County reached it peak, 22,610 in population, 3,296

people paid personal taxes. In 1939 when population was 19,883, there were 4,539

people paid personal taxes. This indicates that there has been a raising of the

standard of living for almost one-fourth of the taxpayers.

Significant

also is the change in the amount of personal property the well-to-do class pays.

In 1900, eleven individuals paid taxes on between $10,000 and $20,000 worth of

personal property and three paid on $20,000 or more. In 1939 only one individual

listed personal property exceeding $10,000. Corporations such as the Central

Illinois Public Service Corporation, the Bell Telephone Company, the Western

Union Telegraph Company and several chain grocery stores and oil companies and

other companies paid taxes on over $10,000 worth of personal property.

Since it is a well known fact that more than one individual has more than

$10,000 worth of personal property which may or may not be taxable, it would be

inaccurate to leave the impression that individual wealth has decreased as much

as the comparison in taxes between 1900 and 1939 indicates. Since the assessor

is only able to list what he sees if the taxpayer does not choose to tell him

what he owns, many things may be missed in compiling tax lists, and since taxes

have increased, people are more inclined to conceal their wealth than they were

in the past. The county assessor made the statement that if an accurate

assessment could be made, the rate of taxation would be about one-fourth the

amount that is now levied.

In listing personal taxes for businesses, in

1900 seventy-six business houses listed personal property of over $1,000 and six

manufacturers had over $1,000 worth of personal property. The largest

manufacturer listed property worth $5,459.

This practice does not exist

in Union County alone.

In 1939 four manufacturers listed personal

property of over $8,000 and one company paid taxes on $35,505. Fifty-six places

of business listed over $1,000 worth of personal property and there were almost

three times as many businesses listed in 1939 as in 1900. It is possible for

many businesses to operate now on a small amount of stock because of the

availability of new stock to replenish what is sold almost over night.

A

discussion of farm taxes was given in the chapter on the history of agriculture.

Types of businesses have changed to meet the times. Instead of the old

general merchandise stores there are specialized stores, ready-to-wear,

groceries, notions, etc. The harness and wagon manufacturers have been replaced

by garages, automobile and farm implement sales companies. The sale of gasoline

is one of the most numerous of businesses in the county.

In conclusion,

let it be said that Union county, altho handicapped by rather poor soil, has

arisen above its handicaps and has its share of business and comforts. While

there are no extremely wealthy people in the county there are many people who

live well. Our poor people are fewer than in our neighboring counties,

Alexander, Pulaski, Jackson, Williamson and Johnson. The county has produced its

share of brilliant people who have made names for themselves in the fields of

business, politics and education.

Union County is above all, a consistent

county. When a leader is chosen he is backed for long periods of time. This is

indicated by the long tenure of office enjoyed by Monroe C. Crawford, who was

county judge for thirty-two years. Judge Crawford was a very fine type of man

which indicates that Union County stands behind officials of high calibre. In

going over the county records, it is found that most of our officials served for

long periods of time.

Most of the pastors in the county serve their

churches for a number of years and there is not a radical amount of change among

teachers. Many of our business houses belong to people whose fathers and

grandfathers were in the same business before them.

On the whole our

citizens are law abiding. We do not have any more arrests in proportion to our

population than other counties have.

On the whole we are an average

county considering the fact that we excel in some things and do not do so well

in others. Most salesmen visiting the county express themselves as finding Union

County the best business county in this end of the state. Our county was born of

courage and hardship. It grew on the fearless spirit of the pioneer and has

become what it is today.

Flag Pole In Anna

Last year the Anna Chamber of Commerce and the American Legion put up a flag

pole on the Illinois Central park.

This picture shows the initial flag raising ceremonies.

Ben H. Smith of Jonesboro, has been recognized nationally for his fine

poetry. Above is his poem on Abraham Lincoln that has been published

throughout the United States.

He contributes a regular weekly column to The Gazette-Democrat.

International Shoe Factory

Leading industry in Union County is the International Shoe Factory in Anna.

It has been in operation here for the past 10 years.

Hale-Willard Hospital

Formerly a private institution when this picture was taken, The Hale-Willard

hospital is now operated by the City of Anna.

Contributed 11 Sep 2017 by Norma Hass, extracted from History of Union County, by Lulu Leonard, published in 1941.

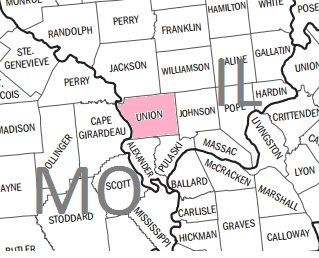

| Jackson | Williamson | |

| MO |

|

Johnson |

| Alexander | Pulaski |